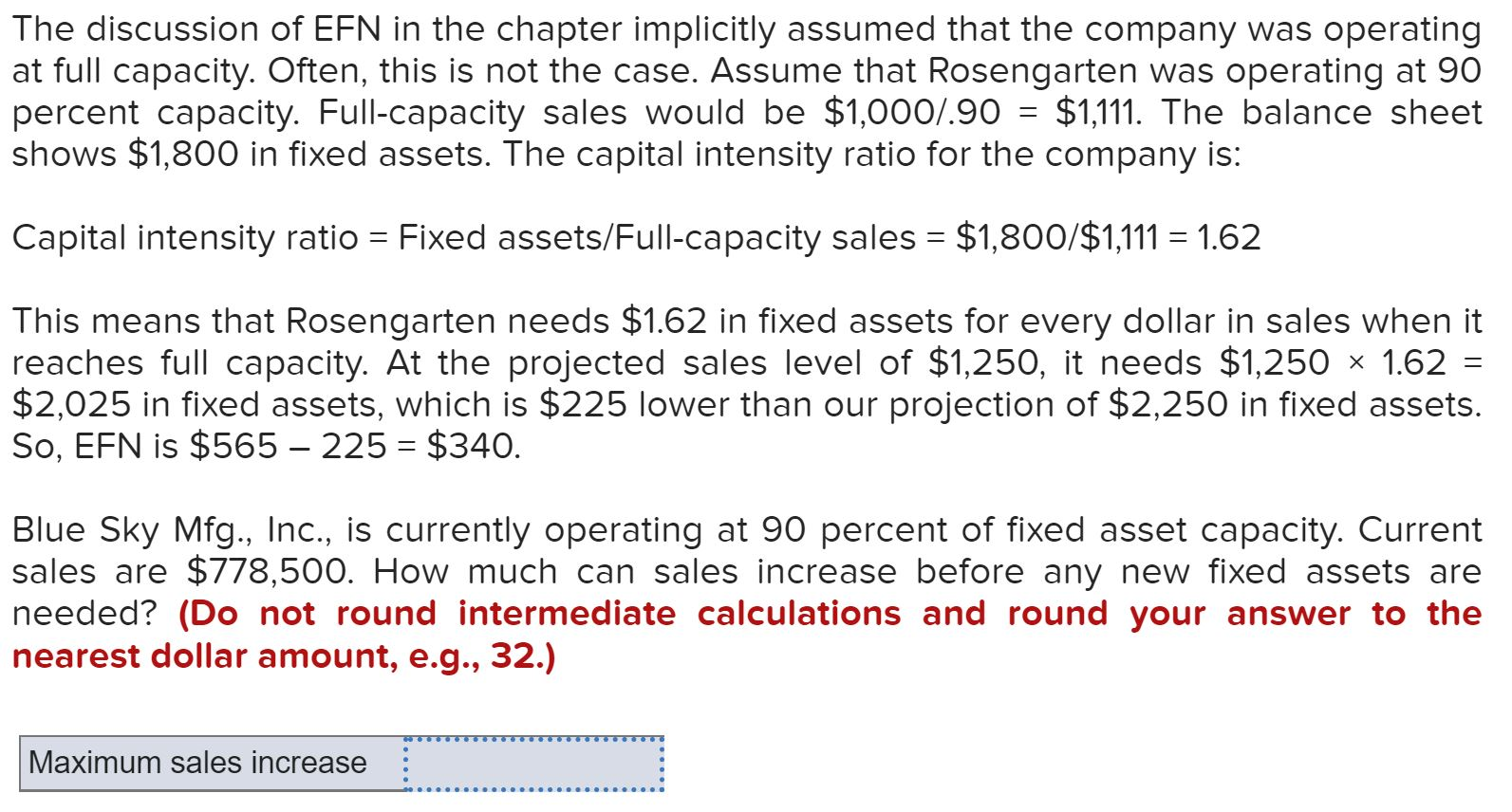

Capacity Planning for Facilities In the context of finance, the sales and profit level for a firm govern the operating capacity for a given financial periodCapital intensity ratio = $6,910 / $7,250 = 95 9 a Increase in retained earnings = ($900 – $630) ( (1 13) = $ 10 c Fullcapacity sales = $5,800 / 75 = $7,;Sambalpur (Odisha) India, Aug 14 (ANI) The authorities on Wednesday released the first flood water of the season from Hirakud Dam as the water level

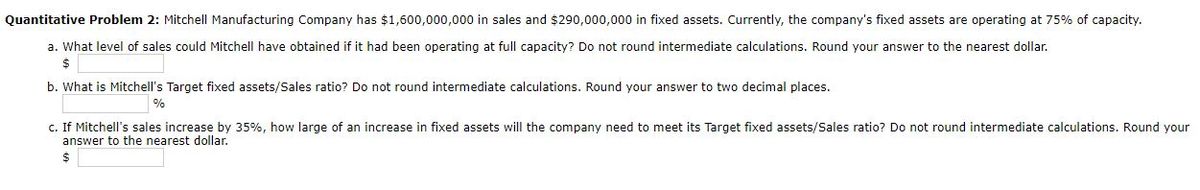

12 2 Mitchell Manufacturing Company Has 1 100 000 000 In Sales And 370 000 000 In Fixed Assets Currently The Compan Homeworklib

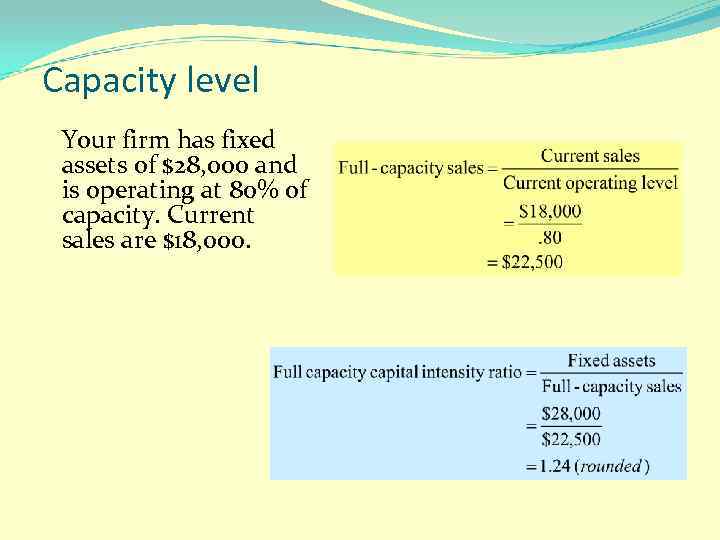

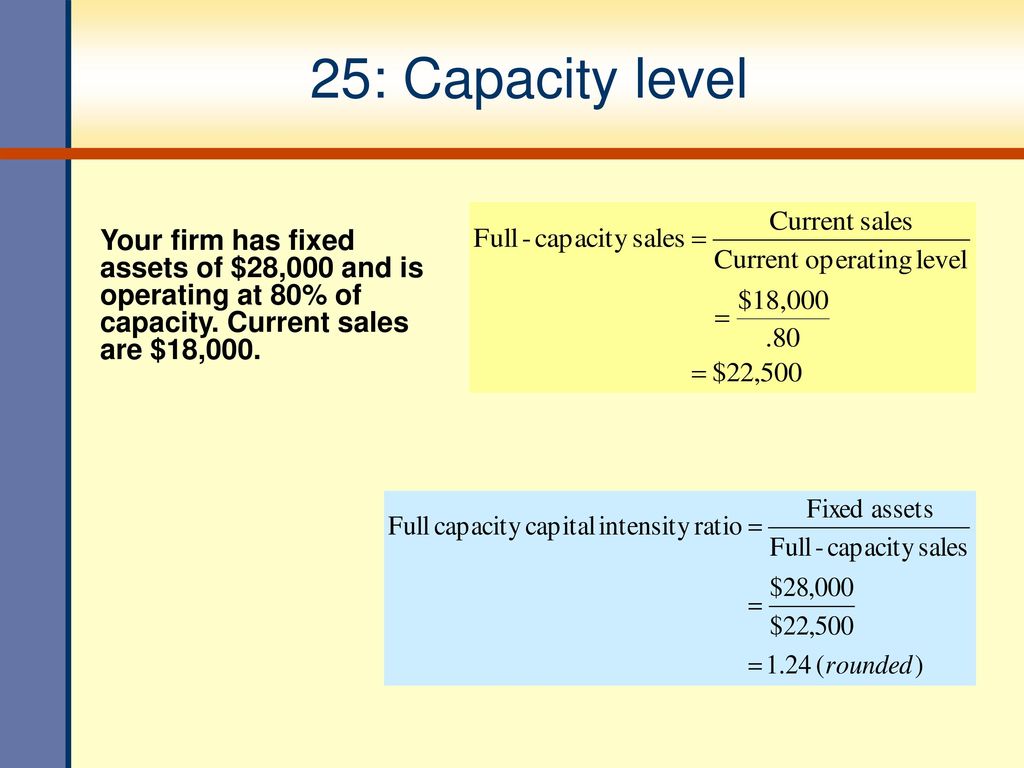

Full capacity level of sales

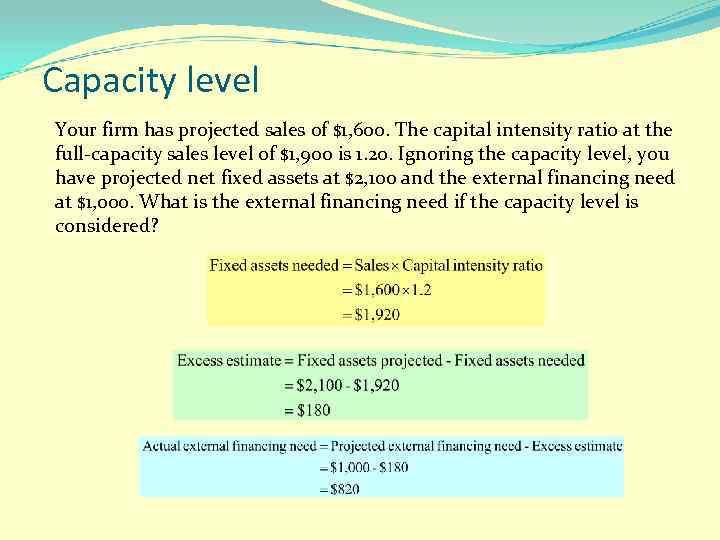

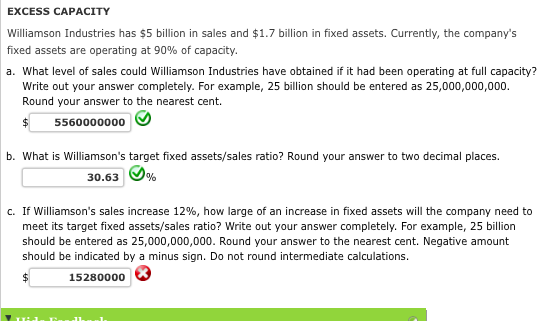

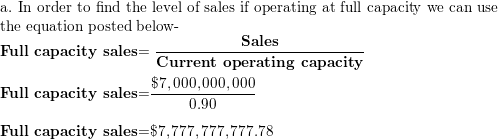

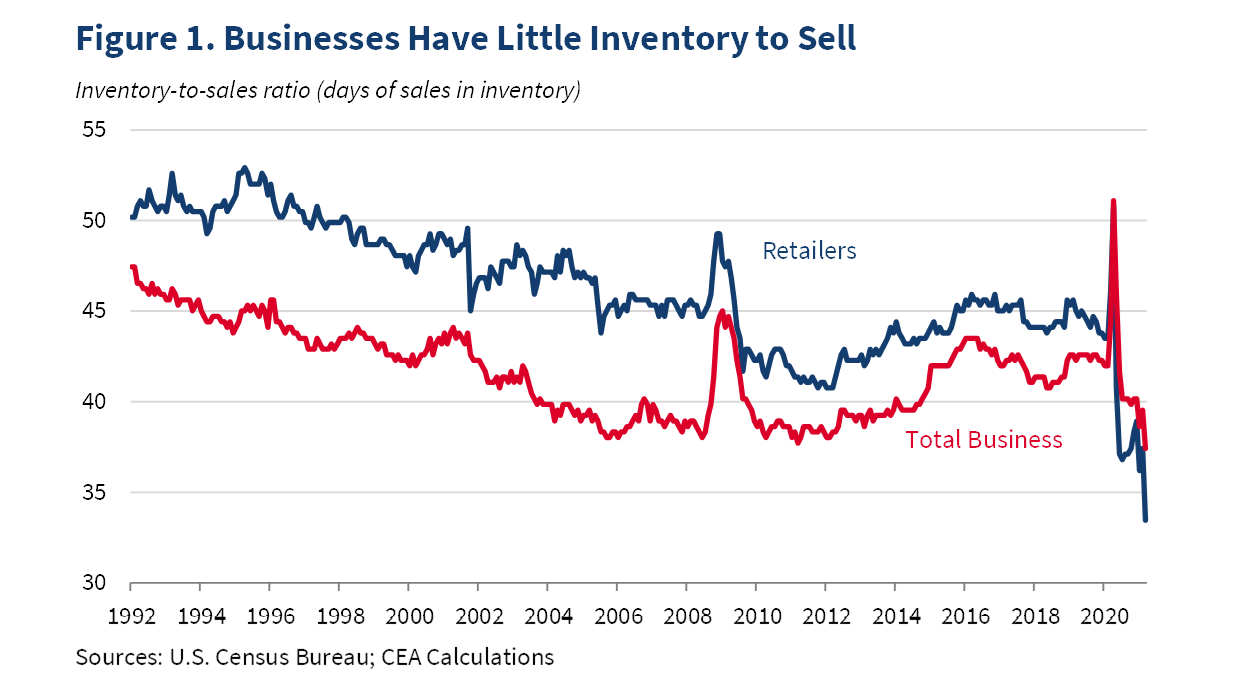

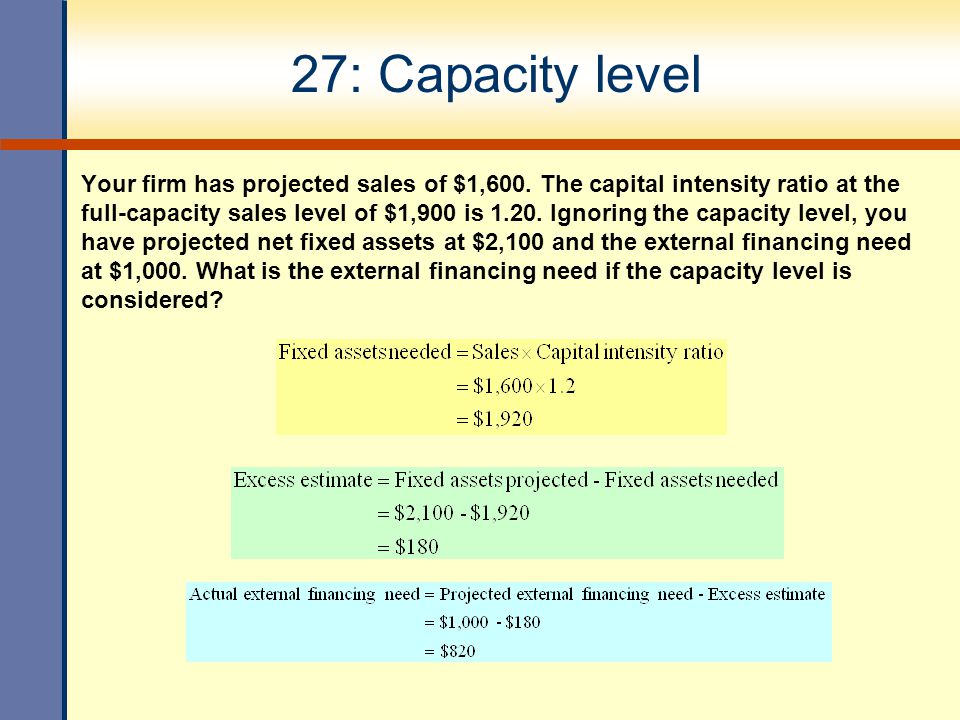

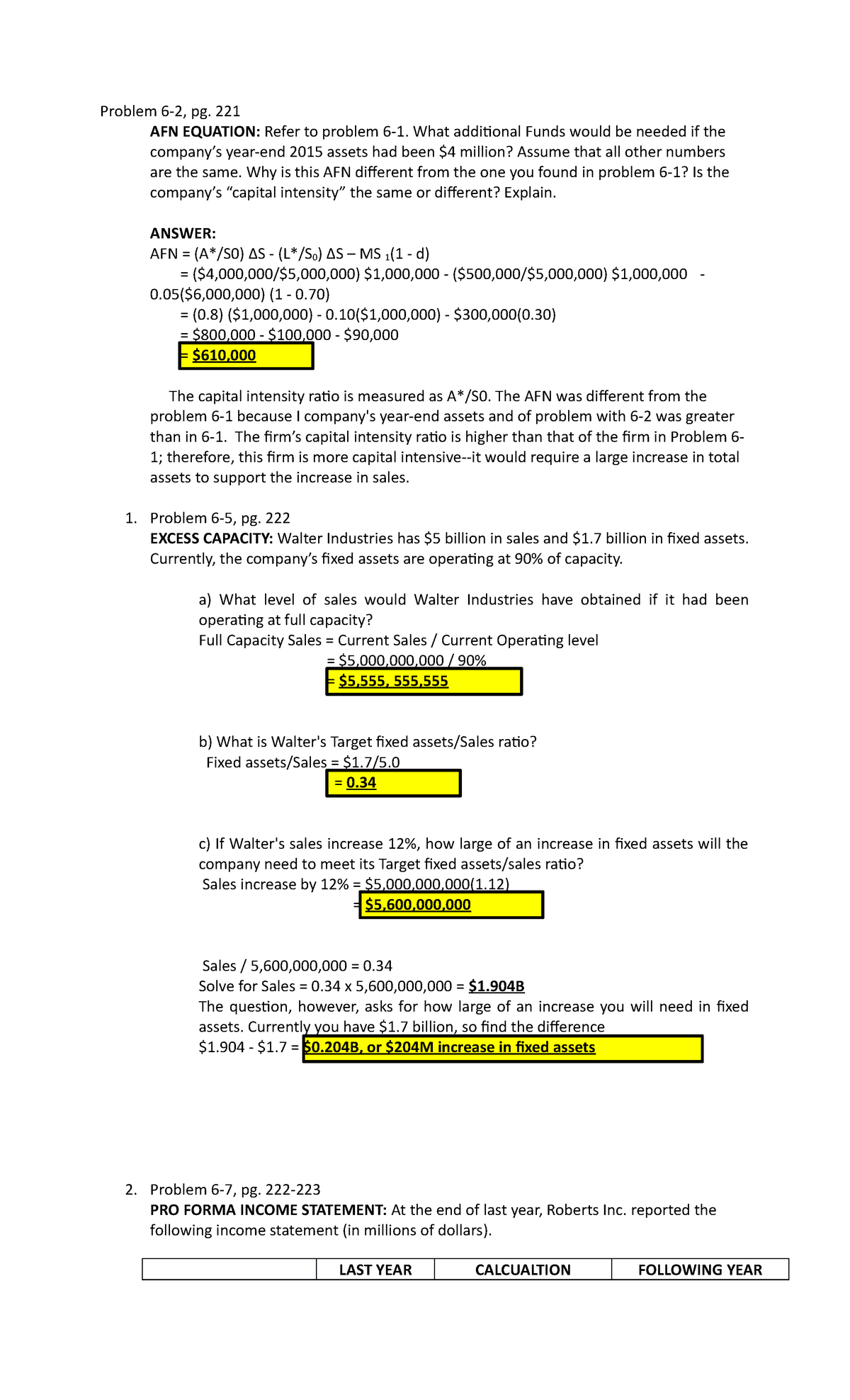

Full capacity level of sales-Williamson Industries has $7 billion in sales and $1944 billion in fixed assets Currently, the company's fixed assets are operating at 90% of capacity First, we need to calculate full capacity sales, which is Full capacity sales = $905,000 / 80 Full capacity sales = $1,131,250 The capital intensity ratio at full capacity sales is Capital intensity ratio = Fixed assets / Full capacity sales Capital intensity ratio = $364,000 / $1,131,250 Capital intensity ratio = The fixed assets required at full capacity sales is the

Solved The Discussion Of Efn In The Chapter Implicitly Chegg Com

In other words, full cost pricing will ensure recovery of total costs and earning of target profit when sales volume is equal to or more than the volume or capacity level which has been used to estimate total unit costs146If a firm is at fullcapacity sales, it means the firm is at the maximum level of production possible without increasing A net working capital B cost of goods sold C inventory D fixed assets E the debt ratio 147The internal growth rate increases when the A retention ratio decreases B dividend payout ratio increases C net income decreases D total assets decreaseFull capacity sales = $510,000 / 86 = $593, Which one of the following ratios identifies the amount of total assets a firm needs in order to generate $1 in sales?

Percentage increase in sales = $7, – $5,800 / Martin Aerospace is currently operating at full capacity based on its current level of assets Sales are expected to increase by 45 percent next year, which is the firm's internal rate of growth Net working capital and operating costs are expected to increase directly with sales The interest expense will remain constant at its current levelFullcapacity = $17,300/080 = 21, 625 5 The most recent financial statements for Moose Tours, Inc follow Sales for 09 are projected to

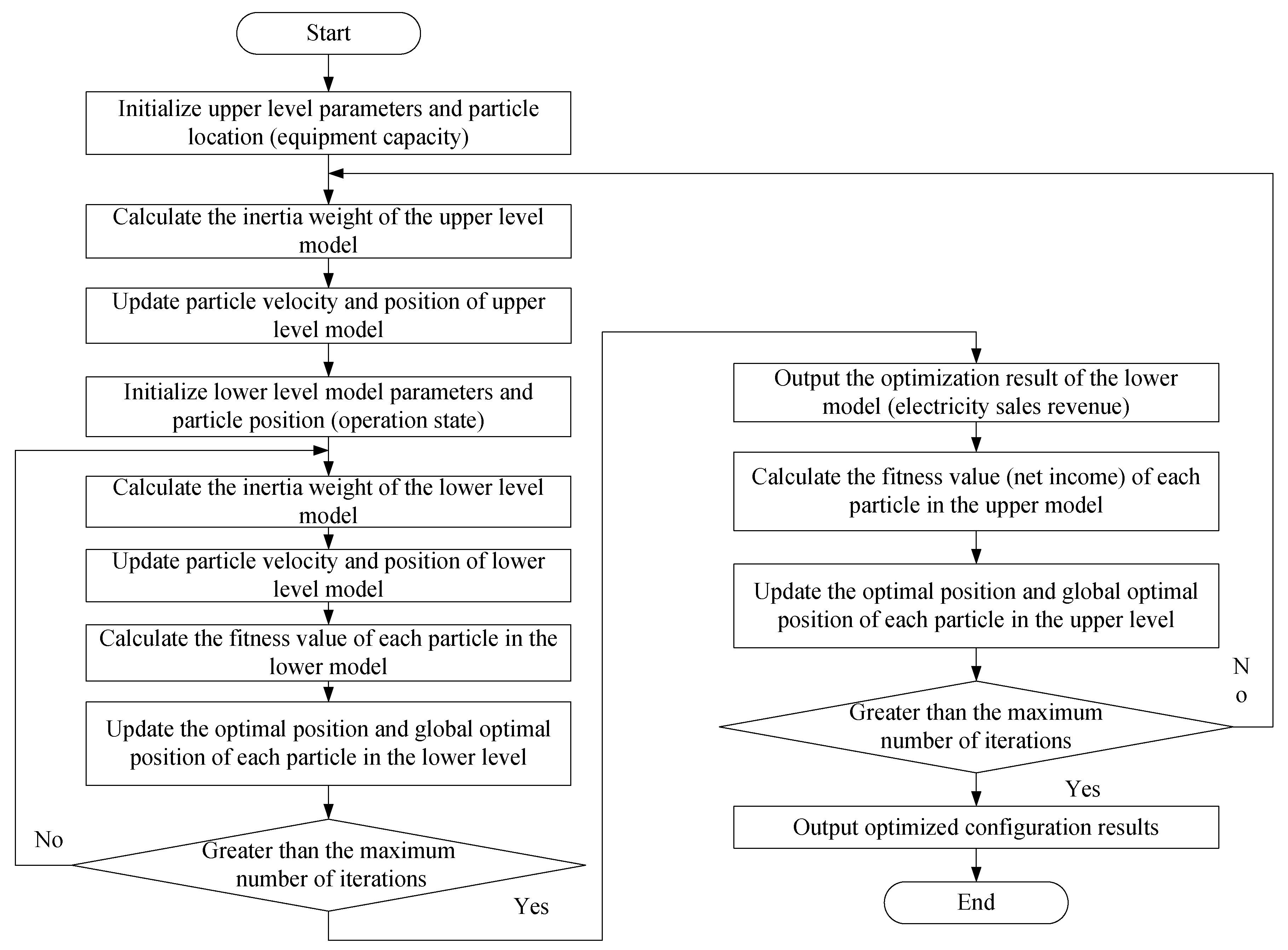

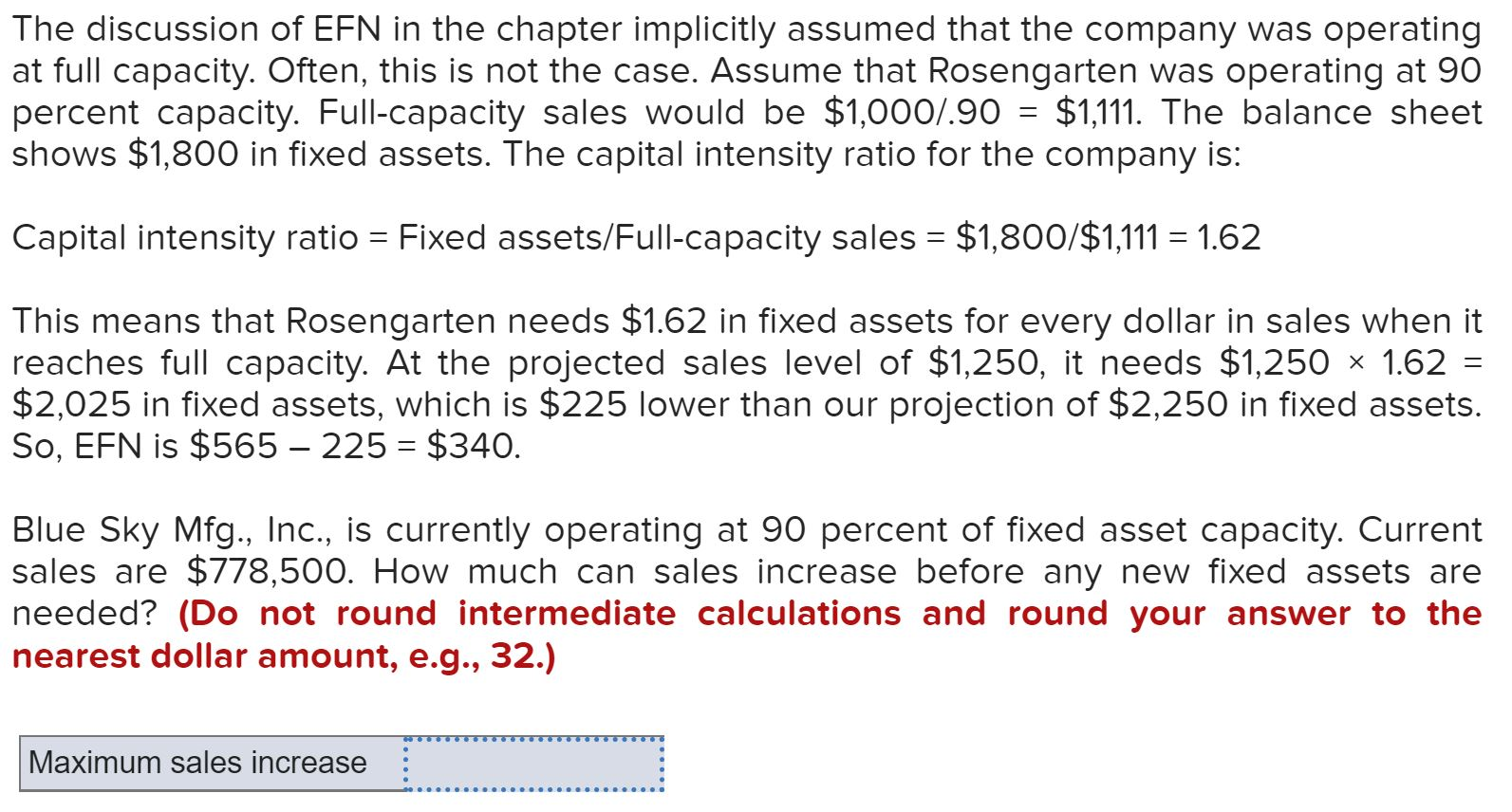

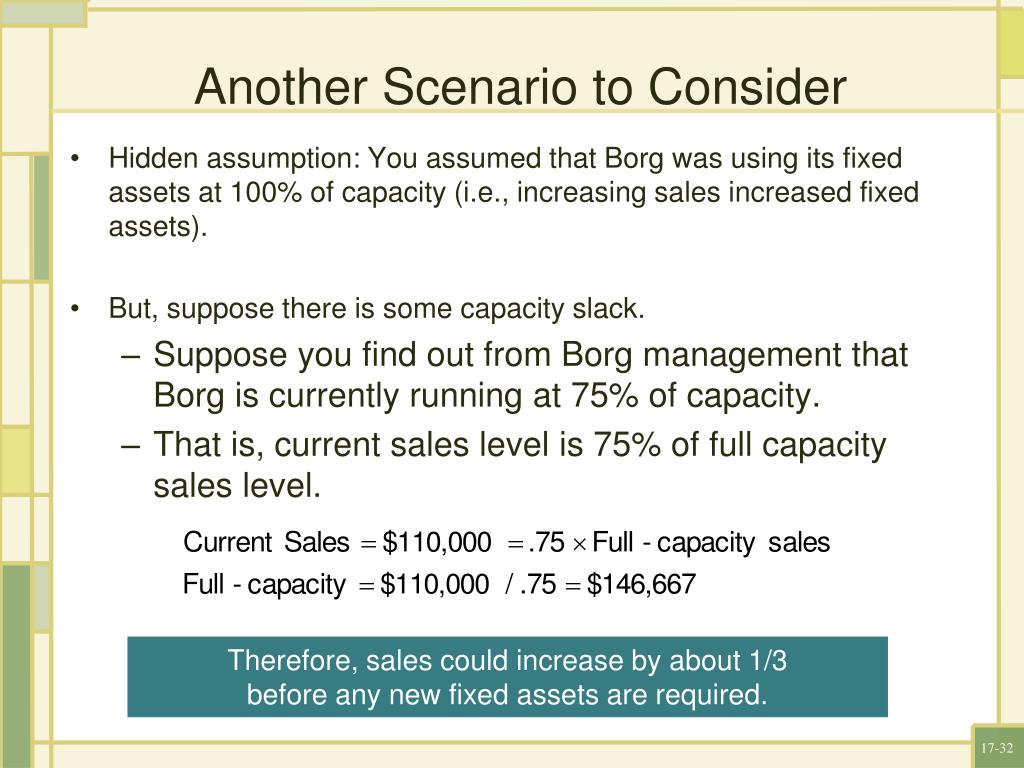

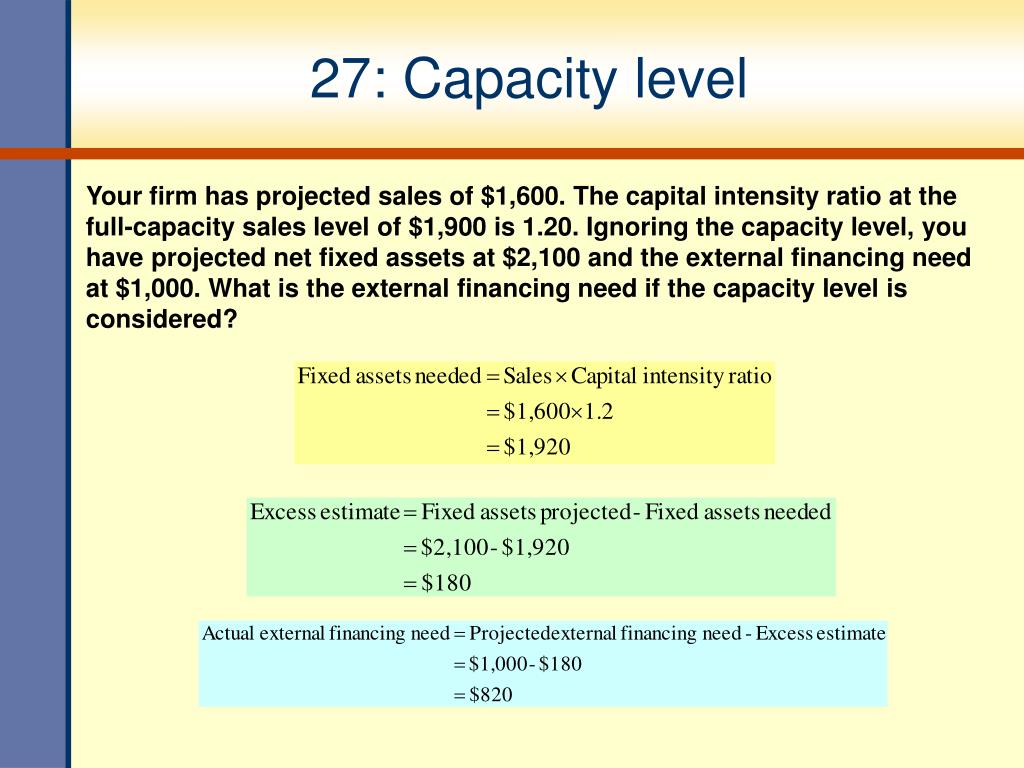

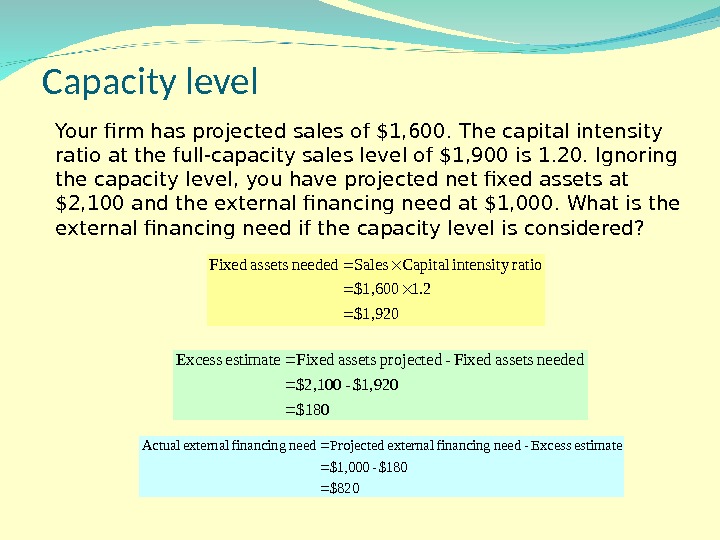

• Fullcapacity sales would be $1,000∕90 = $1,111 From Table 43, fixed assets are $1,800 At full capacity, the ratio of fixed assets to sales is thus • Fixed assets∕Fullcapacity sales = $1,800∕$1,111 = 162 • This tells us that we need $162 in fixed assets for every $1 in sales once we reach fullCurrently, the company's fixed assets are operating at 80% of capacity What level of sales could Mitchell have obtained if it had been operating at full capacity?Wagner Industrial Motors, which is currently operating at full capacity, has sales of $29,000, current assets of $1,600, current liabilities of $1,0, net fixed assets of $27,500, and a 5 percent profit margin The firm has no longterm debt and does not plan on acquiring any The firm does not pay any dividends

Consumer Electronics Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By Sep Retail News Et Retail

Solved Break Even Sales Under Present And Proposed Conditions Howard 1 Answer Transtutors

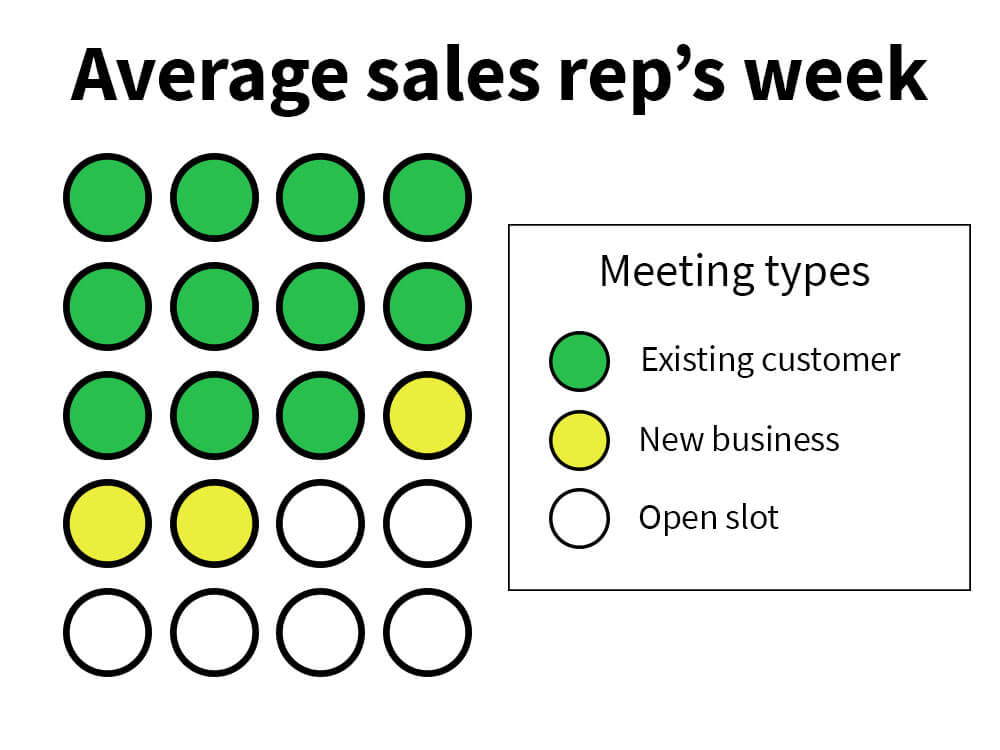

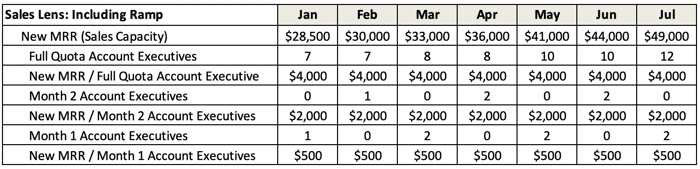

Your sales capacity is the answer you obtain from the following equation the number of sales reps you have on the team, multiplied by the number of weekly hours that your team works per year, multiplied by the percentage of time spent selling and finally multiplied by the closing ratio of your team (typically about 30%)FIN 300 Course URL Managerial Finance 1https//wwwallthingsmathematicscom/p/ryersonfin300Shoot me an email if you have any questions at patrick@allthingsWhat is EFN in this case?

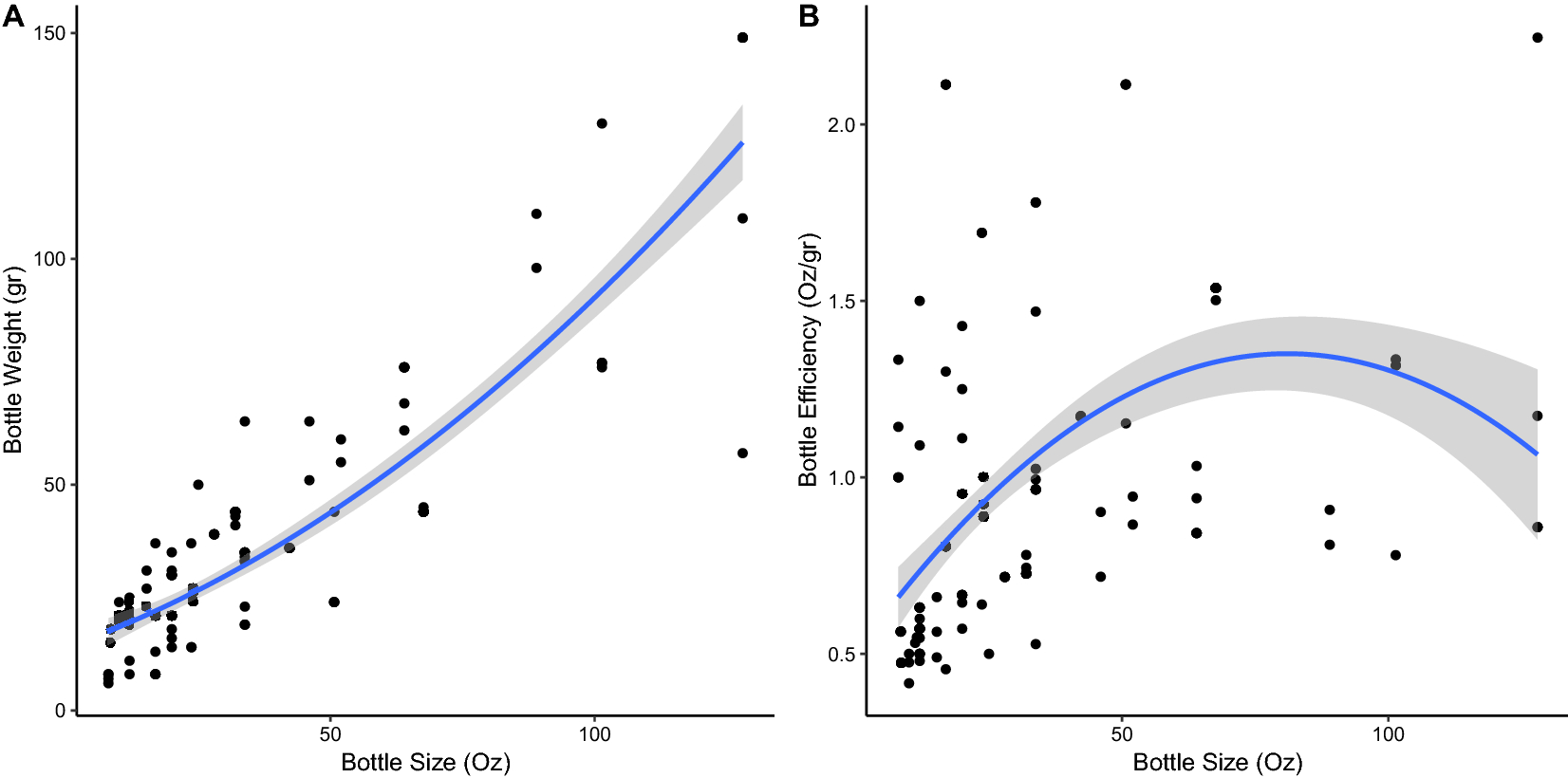

Beverage Bottle Capacity Packaging Efficiency And The Potential For Plastic Waste Reduction Scientific Reports

Sales Commission Structures Everything You Need To Know Xactly

Fullcapacity sales = $611,000/94 Fullcapacity sales = $650,000 Maximum growth without additional assets = 0638, or 638%Quantitative Problem 2 Mitchell Manufacturing Company has $1,000,000,000 in sales and $260,000,000 in fixed assets Currently, the company's fixed assets are operating at 75% of capacity a)What level of sales could Mitchell have obtained if it had been operating at full capacity? The exact amount of capacity to maintain can be planned for using capacity requirements planning, which calculates required capacity levels at different sales levels and product mixes How to Reduce Capacity Costs It is possible to largely eliminate capacity costs by shifting work to third parties

Financial Management Quiz 36 Pdf 69 Award 1 00 Point The Outlet Has A Capital Intensity Ratio Of 87 At Full Capacity Currently Total Assets Are Course Hero

9 Sales Resume Examples That Landed Jobs In 21

Fullcapacity sales = Future sales level Percent of capacity used to generate existing sales level Fullcapacity sales = Existing sales level Percent of capacity used to generate existing sales level Fullcapacity sales Existing sales level (1 Percent of capacity used to generate existing level of assets) Full capacity sales Future sales level (1 Percent of capacity used toFullcapacity sales = $878,000 / 93 = $944, Capital intensity ratio = $913,000 / $944, = 97 Frasier Cabinets wants to maintain a growth rate of 5 percent without incurring any additional equity financingThe company's capacity utilization rate is 50% (,000/40,000) * 100 If all the resources are utilized in production, the capacity rate is 100%, indicating full capacity If the rate is low, it signifies a situation of "excess capacity" or "surplus capacity"

11 Sales Metrics That Highly Productive Teams Track

/dotdash_Final_Profit_Margin_Aug_2020-01-af95cd42bbde486e83a4e50eef10e005.jpg)

Profit Margin Definition

At its simplest, the formula for traditional Sales Capacity Planning = SR * H * W * CR * ST As an example, a sales team with seven reps, working 45 weeks per year, with a 30% closing rate and a 40% selling time, the formula would be Sales Capacity = SR (7) * H (40) * W (45 weeks / year) * CR (28%) * ST (40%) This results in a total sales capacity of 1081 sales/year for the team TheWhat is the fullcapacity level of sales?A $148,148 B $10,800 C $40,000 D $54,795 Capacity Level For Sales In the parlance of Finance, the

A Main Goal Satisfaction B Cash Level Status C Sales Orders Download Scientific Diagram

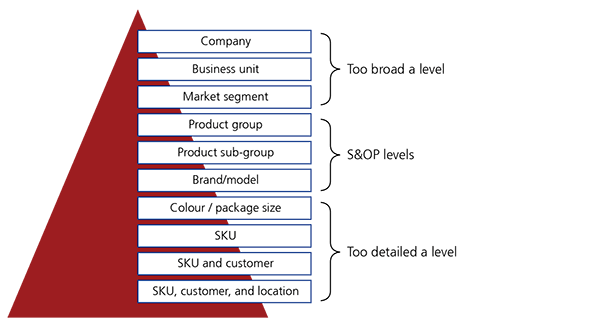

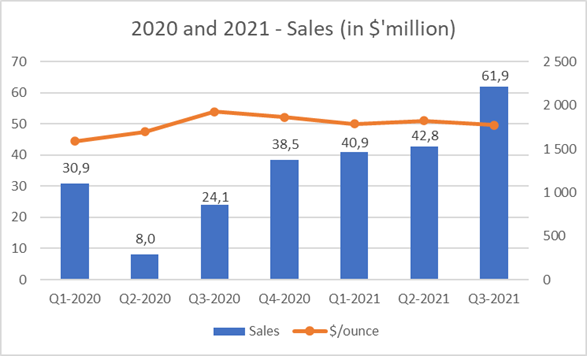

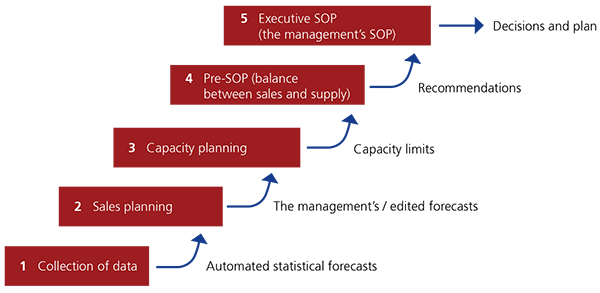

Sales And Operations Planning Relex Solutions

Level of sales = Sales / Operating capacity = 7,000,000,000/90% = $7,777,777, b Calculation of Target fixed Assets/Sales ratio Fixed assets sales ratio = Fixed assets / Level of sales = 1,944,000,000/7,777,777, = = 025 c Calculation of Increase in Fixed assets Increase in fixed assets = Fixed assets sales ratio * (Increase in sales Level of sales)What is the nursery's full capacity level of sales?Full capacity sales refers to the optimal sales amount, up to which situation a firm does not need the help of any external financing for the assets In this case, S Mfg Inc is currently operating at 92 percent of fixed asset capacity and its current sales are $690,000

1

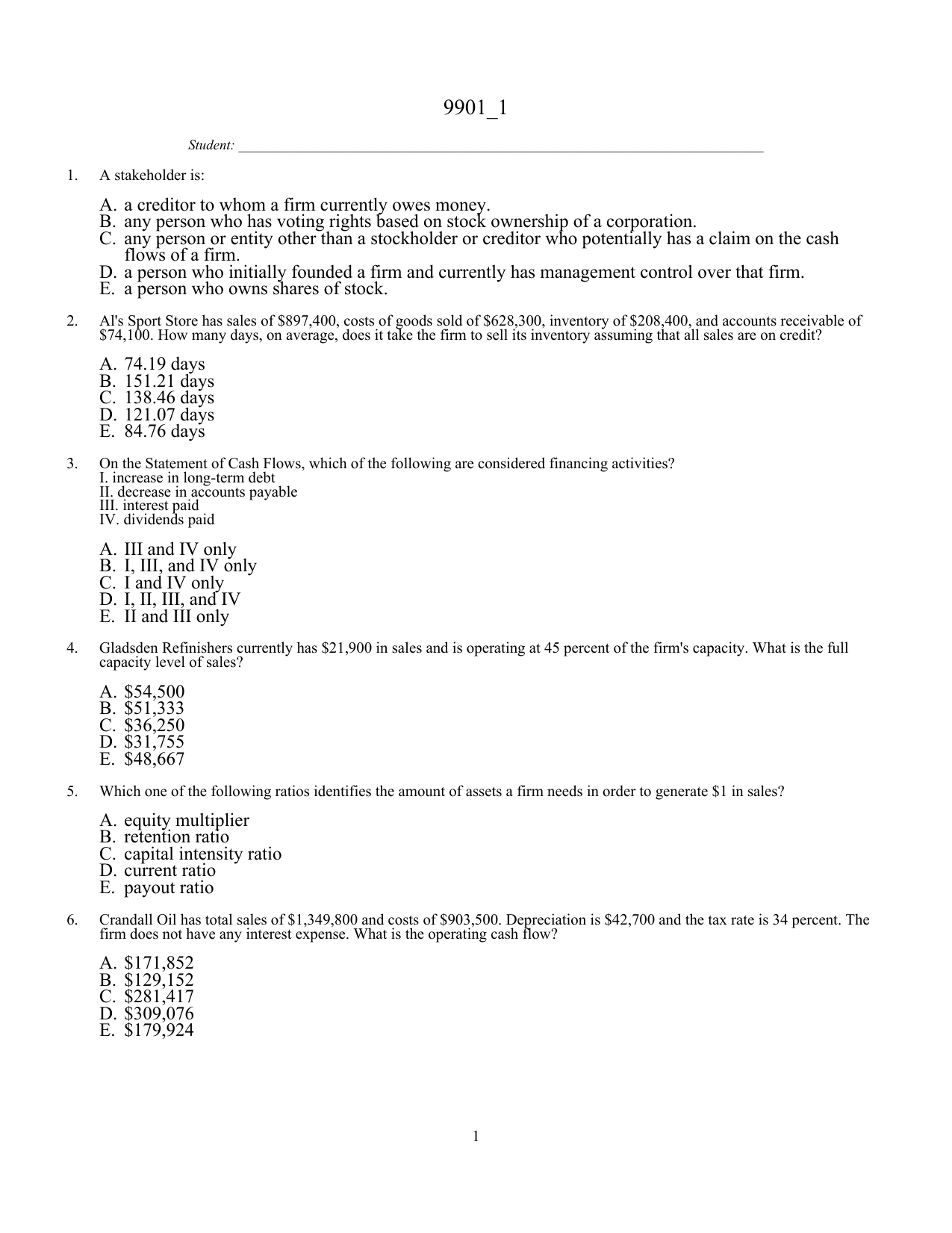

9901 1 A Days B Days C Days D Days E Days Pdf Free Download

What is the full capacity level of sales?If information as to total contribution at full capacity is available, the breakeven point as a percentage of estimated capacity can be found as under BEP (as % age of capacity) = Fixed Cost/Total Contribution Illustration 1 From the following information, calculate the breakeven point in units and in sales value Output = 3,000 unitsWhat is the fullcapacity level of sales?

12 2 Mitchell Manufacturing Company Has 1 100 000 000 In Sales And 370 000 000 In Fixed Assets Currently The Compan Homeworklib

Energies Free Full Text Bi Level Capacity Planning Of Wind Pv Battery Hybrid Generation System Considering Return On Investment Html

Capacity is the maximum level of output that a company can sustain to make a product or provide a service Planning for capacity requires management to accept limitations on the production processFull capacity sales Sales = $3,000,000,000;Round your answer to the nearest dollar Do not round

Solved The Discussion Of Efn In The Chapter Implicitly Chegg Com

How To Do Your Annual Sales Capacity Planning

16 Assume the firm has a constant dividend payout ratio and a constant debtequity ratio What is the the maximum growth rate (Sustainable Growth Rate) the firm can achieve without any external equity financing?42 Fullcapacity sales are equal to current sales divided by the capacity utilization At 60 percent of capacity $4,250 60 Fullcapacity sales $7,0 Fullcapacity sales With a sales level of $4,675, no net new fixed assets will be needed, so our earlier estimate is too high We estimated an increase in fixed assets of $2,4Fullcapacity sales = $611,000/094 = $650,000 Maximum growth without additional assets = ($650,000/$611,000) 1 = 638 percent Stop and Go has a 45 percent profit margin and a 15 percent dividend payout ratio

Sales Capacity Planning Are You Getting The Most Out Of Your Sales Team Espatial

6 Strategies For When Sales Hit Production Capacity

What is the full capacity level of sales?47 Gladsden Refinishers currently has $21,900 in sales and is operating at 45 percent of the firm's capacity What is the full capacity level of sales?Fixed assets/Sales at full capacity 16 At the projected level of sales, the fixed asset requirement for the company is ROSENGARTEN CORPORATION Current assets Current liabilities Cash $ 0 Accounts payab Accounts receivable 550 Notes payable Inventory 750 Total Total $ 1,500 Longterm debt Owners' equity Fixed assets Common stock Net plant and equipment $

Worksheet Business Finance Pdf Return On Equity Dividend

Accounting Help Hungry Howie S Is Currently Operating At 96 Percent Of Capacity The Profit Margin And The Dividend Payout Ratio Are Projected To Remain Constant

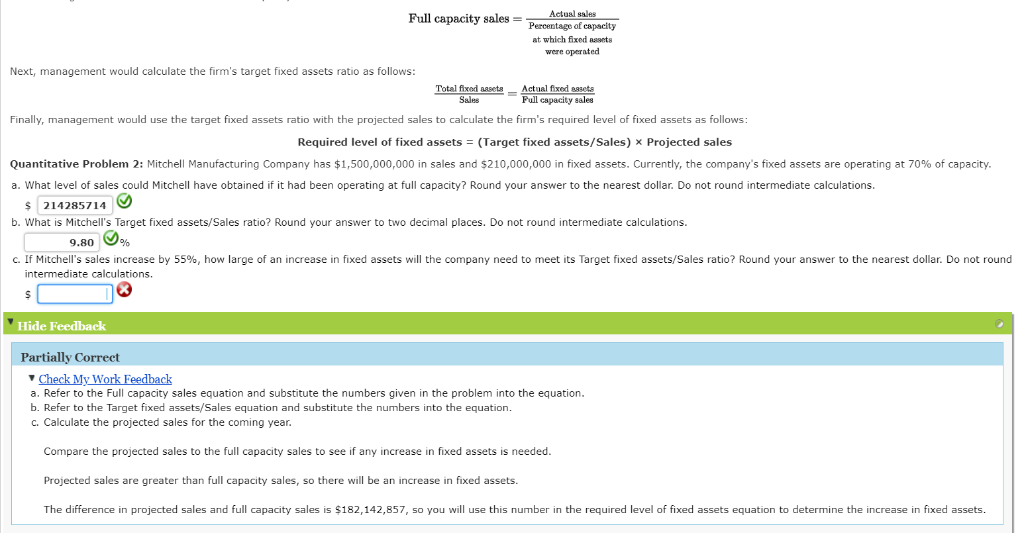

101 Boa Mining Company currently is operating at less than 50% of practical capacity The management of the company expects sales to drop below the present level of 10,000 tons of ore per month very soon The sales price per ton is $3 and the variable cost per ton is $2 Fixed costs per month total $10,000View Financial Management Quiz 36pdf from FINANCE MISC at University of the Fraser Valley 69 Award 100 point The Outlet has a capital intensity ratio of 87 at full capacity Currently, total Full capacity sales = Actual sales Percentage of capacity at which fixed Assets were operated Next, management would calculate the firm's target fixed assets ratio as follows Total fixed as Sales Actual fixed assets Pull capacity sales Finally, management would use the target fixed assets ratio with the projected sales to calculate the firm's required level

South African Government Happy Saturday A Reminder That Gatherings Are Permitted Indoor Gatherings Maximum Capacity Is 250 People And For Outdoor Capacity Is 500 People Also You Still Need

Long Term Financial Planning And Growth Ch 4

A 1,600,000 B 2,000,000A firm is currently operating at full capacity and owns sufficient assets to just support that level of sales Sales are expected to increase at the internal rate of growth next yearNet working capital and operating costs are expected to increase directly with sales The interest expense, the tax rate, and the dividend payout ratio are fixedIf in a given year these assets are being used to only 80% of capacity and the sales level in that year is 2 million, calculate the full capacity sales level?

Qssnc9ka8psfvm

Sales And Operations Planning Relex Solutions

The percent of sales method is a financial forecasting model in which all of a business's accounts — financial line items like costs of goods sold, inventory, and cash — are calculated as a percentage of sales Those percentages are then applied to future sales estimates to project each line item's future valueSelect one a $1,080 b $3,000 c $4,500 d $7 e $2,0 Question A Langley firm currently has $1,800 in sales and is operating at 60 percent of the firm's capacity8 b Fullcapacity sales = $5,800 / 80 = $7,250;

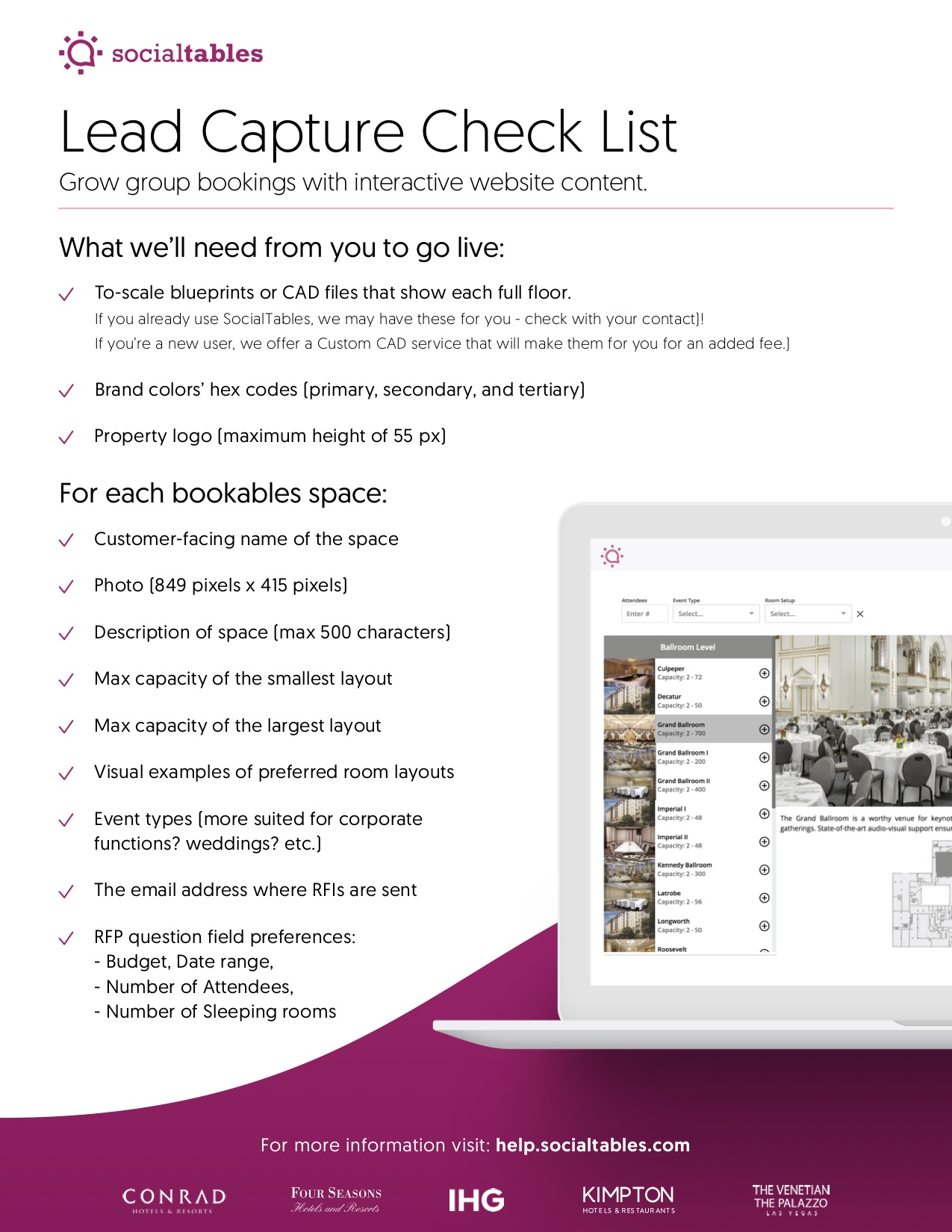

Social Tables Setting Up Event Sales

Long Term Financial Planning And Growth Ppt Download

The Sales Productive Capacity Calculator helps sales and sales operations leaders take a datadriven approach to understanding and measuring the productive capacity of their sales teams and identify levers they can apply to improve sales capacity The tool allows users to model the sales productive capacity of a sales role in a future period17 Assume the firm has a constant dividend payout ratio and a projected sales increase ofBreakeven point (in sales value) = B/E point in units x Selling price per unit = 6 000 x N$32 = N$192 000 12 Profitvolume graph 75% Capacity = Sales of N$2 000 (9 000 units) → This was given in the question N$2 000 (9 000 units) 100 Therefore, 100% Capacity = 1 X 75 = N$384 000 (12 000 units)

Long Term Financial Planning And Growth Ch 4

Solved Excess Capacity Williamson Industries Has 5 Bilion Chegg Com

19 hours ago GLOBE Telecom, Inc is hoping to scale up its data center capacity and capture more of the latent demand for data center services in the country Globe is currently in advanced discussions with Singaporebased ST Telemedia Global Data Centres (STT GDC), a data center provider, on the Ayalaled telco's data center business in the PhilippinesFA are operated at 85% capacity Full capacity sales = Actual sales/(% of capacity at which FA are operated) = $3,000,000,000/085 = $3,529,411,765 47 Target fixed assets/sales ratio Answer b Diff E N Answer c Diff E N Answer e Diff M N Target FA/Sales ratio = $800,000,000/$3,529,411,765Fullcapacity sales = Existing sales level Ã(1 Percent of capacity used to generate future level of assets)4) What is the other name for par value of a preferred stock??a ?

Capacity Utilization Definition Example And Economic Significance

What Is Sales Capacity Planning

Matching Sales Capacity With Demand Gen Using A Bottoms Up Growth Model

Are You Calculating Your Sales Capacity Correctly Pivotal Advisors

Answered Quantitative Problem 2 Mitchell Bartleby

Singapore S September Bunker Sales Fall To 15 Month Low Bunker Tanker News Bunker Tanker Bunker Ports News Worldwide

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Asset Turnover Ratio Definition Formula Examples

Plants Working At 70 Capacity Aiming For Optimal Level Soon Adani Wilmar Business Standard News

Covid 19 Is A Persistent Reallocation Shock Bfi

Covid 19 Is A Persistent Reallocation Shock Bfi

10 Long Term Impacts Of Covid 19 On Biopharma Cbpartners

Capacity Planning 101 Building A Sales Plan

5 Steps To Build An Accurate Restaurant Sales Forecast In 21

Williamson Industries Has 7 Billion In Sales And 1 944 Bill Quizlet

Godrej Appliances Plans To Reach Full Production Capacity From August Sales Already At Pre Covid Level The Economic Times

Why The Pandemic Has Disrupted Supply Chains The White House

Ppt Learning Objectives Powerpoint Presentation Free Download Id

Long Term Financial Planning And Growth Ppt Video Online Download

Determine The Amount Of Sale Units That Wpuld Be Necessary Under Break Even Sales Present And Proposed Homeworklib

Chapter 4 Longterm Financial Planning And Growth Mc

Fundamentals Of Corporate Finance 3e Ch04

Capacity Utilization Rate Formula Calculator Excel Template

Solved Full Capacity Sales Actual Sales Percentage Of Chegg Com

Financial Management Case Problem 6 2 Pg 221 Afn Equation Refer To Problem 6 1 What Additional Studocu

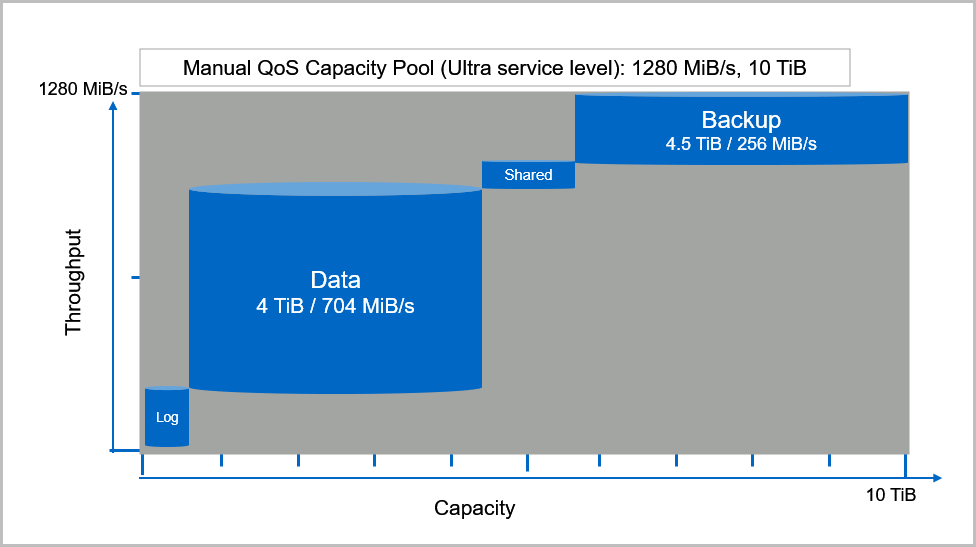

Service Levels For Azure Netapp Files Microsoft Docs

Sales Capacity Assessment Suite Hiring Report

Low Price Lead Acid Lifepo4 Lithium Li Ion Battery Capacity Level Indicator Voltage Meter Looking For Sales Agent Www Eyeboston Com

Solved Problem 3 19 Full Capacity Sales The Discussion Of Chegg Com

Fin 300 Full Capacity Sales Of Fixed Assets Example 1 Ryerson University Youtube

The Impact Of Covid 19 On Sales And Production The Cpa Journal

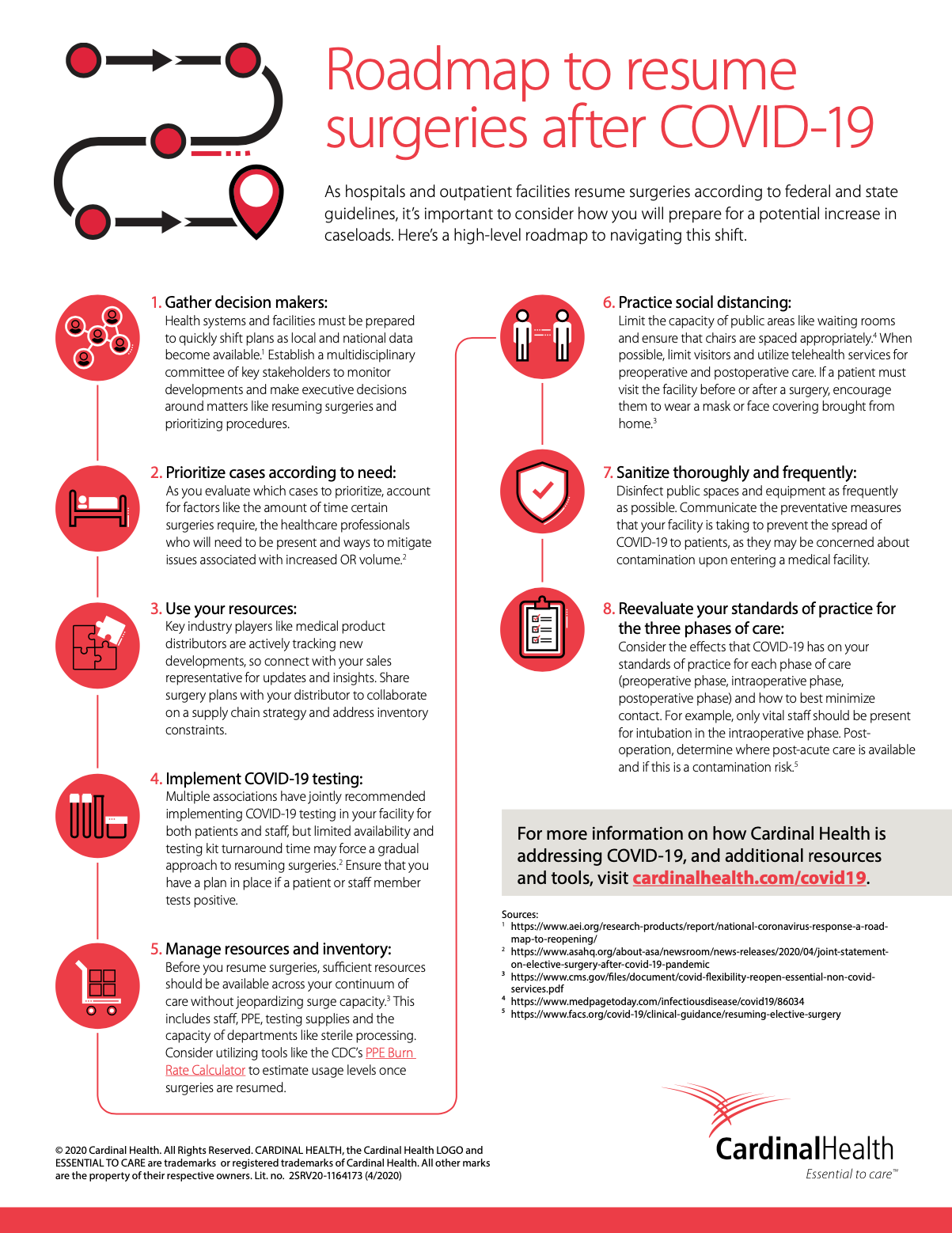

Roadmap To Resume Surgeries After Covid 19

Capacity Planning 101 Building A Sales Plan

Entry Level Sales Resume Examples Template 10 Writing Tips

Uk S Road Fuel Sales Drop Back After Panic Buying Drains Pumps S P Global Platts

First We Need To Calculate Full Capacity Sales Which Is Full Capacity Sales Course Hero

Number Of Cars Sold In The U S Per Year 1951 Statista

Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By September Indiaretailing Com

Gartner Blog Network

Ppt Long Term Financial Planning And Growth Powerpoint Presentation Free Download Id

Sales Assessment For Sales Team Capacity Score Selling Sales Training

Plowback And Dividend Payout Ratios Your Company Has

When Ceos Make Sales Calls

Capacity Based On Sales Expectancy In Business Steemit

Break Even Point

A Main Goal Satisfaction B Cash Level Status C Sales Orders Download Scientific Diagram

Capacity Requirements For Delta Synthetic Fibres Assignment

Tsmc Predicts That 5g Phone Sales Could Hit 300 Million Units Next Year Gizmochina

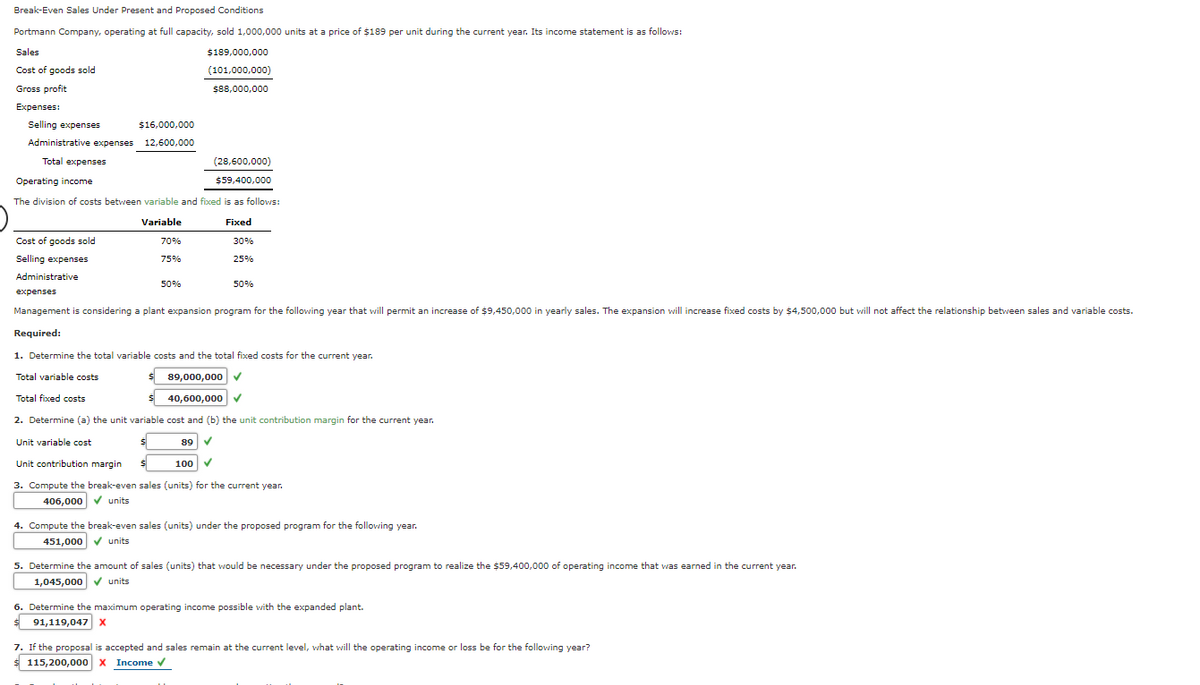

Solved Break Even Sales Under Present And Proposed Conditions Portmann Company Operating At Full Capacity Sold 1 000 000 Units At A Price Of 1 Course Hero

Sales Commission Structures Everything You Need To Know Xactly

Break Even Sales Under Present And Proposed Conditions Battonkill Company Operating At Full Capacity Sold 101 400 Units Homeworklib

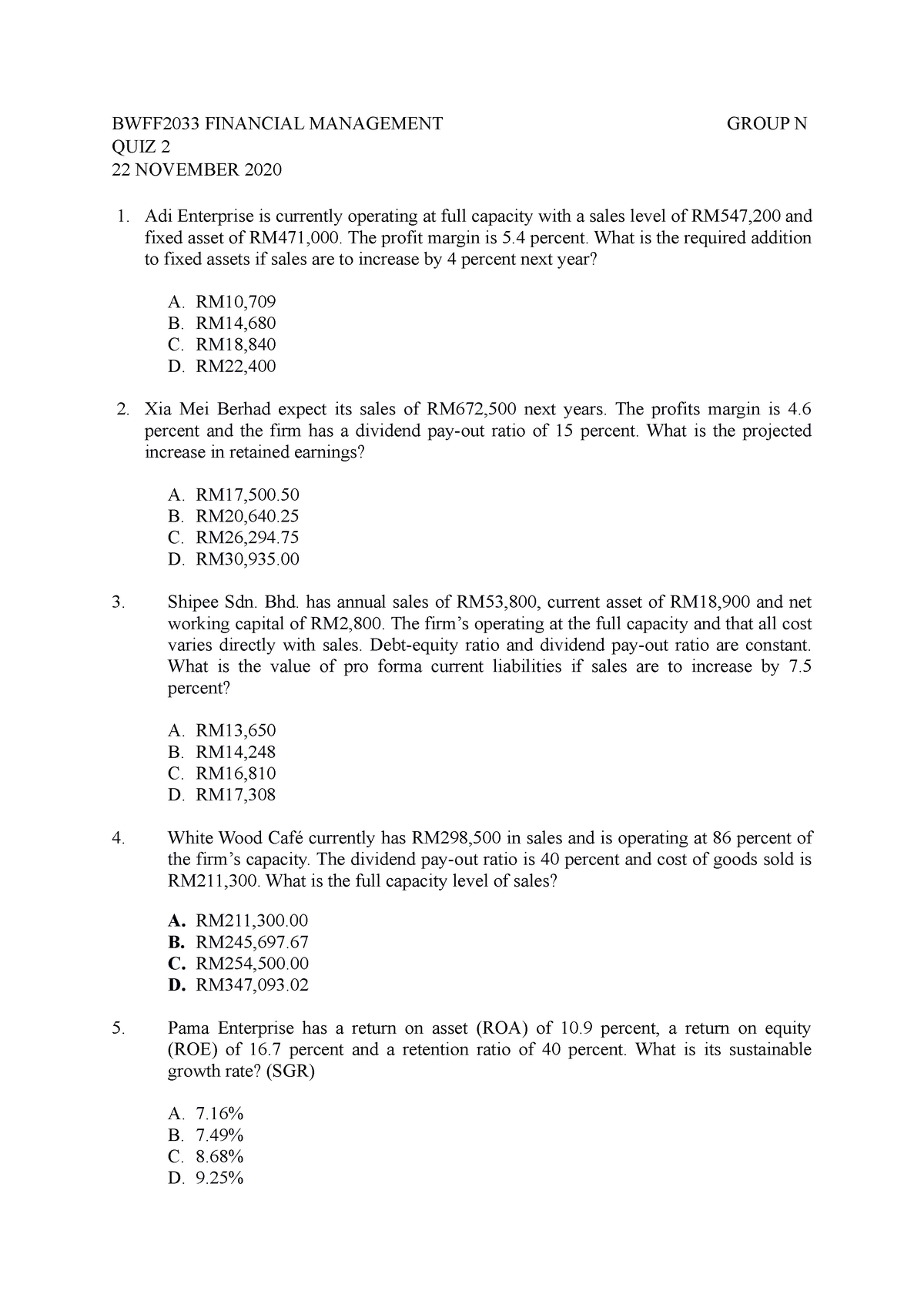

Quiz 2 Quiz Bwff33 Financial Management Group N Quiz 2 22 November Adi Enterprise Is Studocu

Information Sharing For Sales And Operations Planning Contextualized Solutions And Mechanisms Sciencedirect

Chapter 17 Mc Grawhillirwin Projecting Cash Flow And

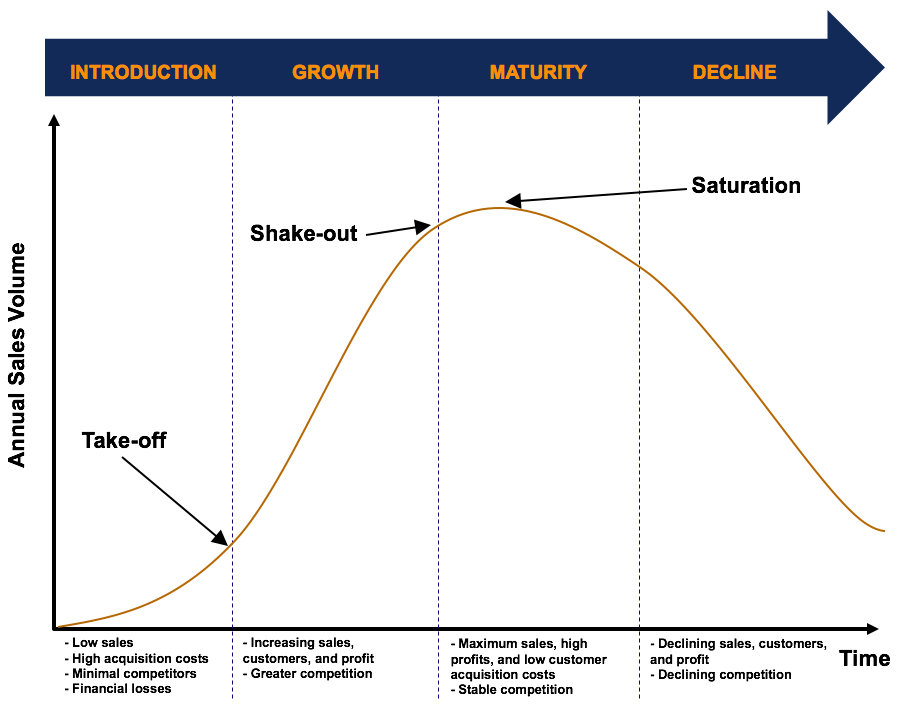

Product Life Cycle Overview Four Stages In The Product Life Cycle

Answered Break Even Sales Under Present And Bartleby

Business Process Framework Tm Forum

Determine The Amount Of Sales Units That Would Be Necessary Under Break Even Sales U 1 Online Essay Typer

Capacity Formula Operations

2

How To Increase Sales Team Capacity Openview Labs

A A Creditor To Whom A Firm Currently Owes Money B Any Person

Get Answer Break Even Sales Under Present And Proposed Conditions Darby Transtutors

Accounting Help Hungry Howie S Is Currently Operating At 96 Percent Of Capacity The Profit Margin And The Dividend Payout Ratio Are Projected To Remain Constant

2

Do Not Hit Your Sales Quota Sales Hacker

Hw 2 Solutions Pdf Retained Earnings Dividend

Investmentfund Twitter Search

When Ceos Make Sales Calls

Homeworkmarket Com

Chapter 4 Longterm Financial Planning And Growth Mc

Utility Scale Battery Storage Capacity Continued Its Upward Trend In 18 Today In Energy U S Energy Information Administration Eia

Godrej Appliances Sales Reach Pre Coronavirus Level Expect Full Capacity Utilisation By September

Sales Capacity Planning Are You Getting The Most Out Of Your Sales Team Espatial

Ball Arena Full Capacity Approved For Next Round Of Nba Nhl Playoffs Denver Nuggets

0 件のコメント:

コメントを投稿